FEATURED HEADLINE

On July 23, 2025, this report delves into the troubling practices of Royal Bank of Canada, Canada’s largest financial institution, exposing a pattern of alleged corruption, public backlash, and what appears to be tyrannical debanking decisions, with a particular focus on the case of Eva T Chipiuk. The bank’s actions, overseen by senior executives David McKay, Graeme Hepworth, and Maria Douvas, have sparked widespread criticism, fueling perceptions of politically motivated overreach and ethical failures. While all information presented is factual, drawn from publicly available sources as of July 23, 2025, this report amplifies the severity of these issues to reflect the outrage felt by affected clients and the public, using precise language to avoid legal liability while delivering a scathing critique of RBC’s leadership and their apparent complicity in decisions that seem unreasonable and discriminatory.

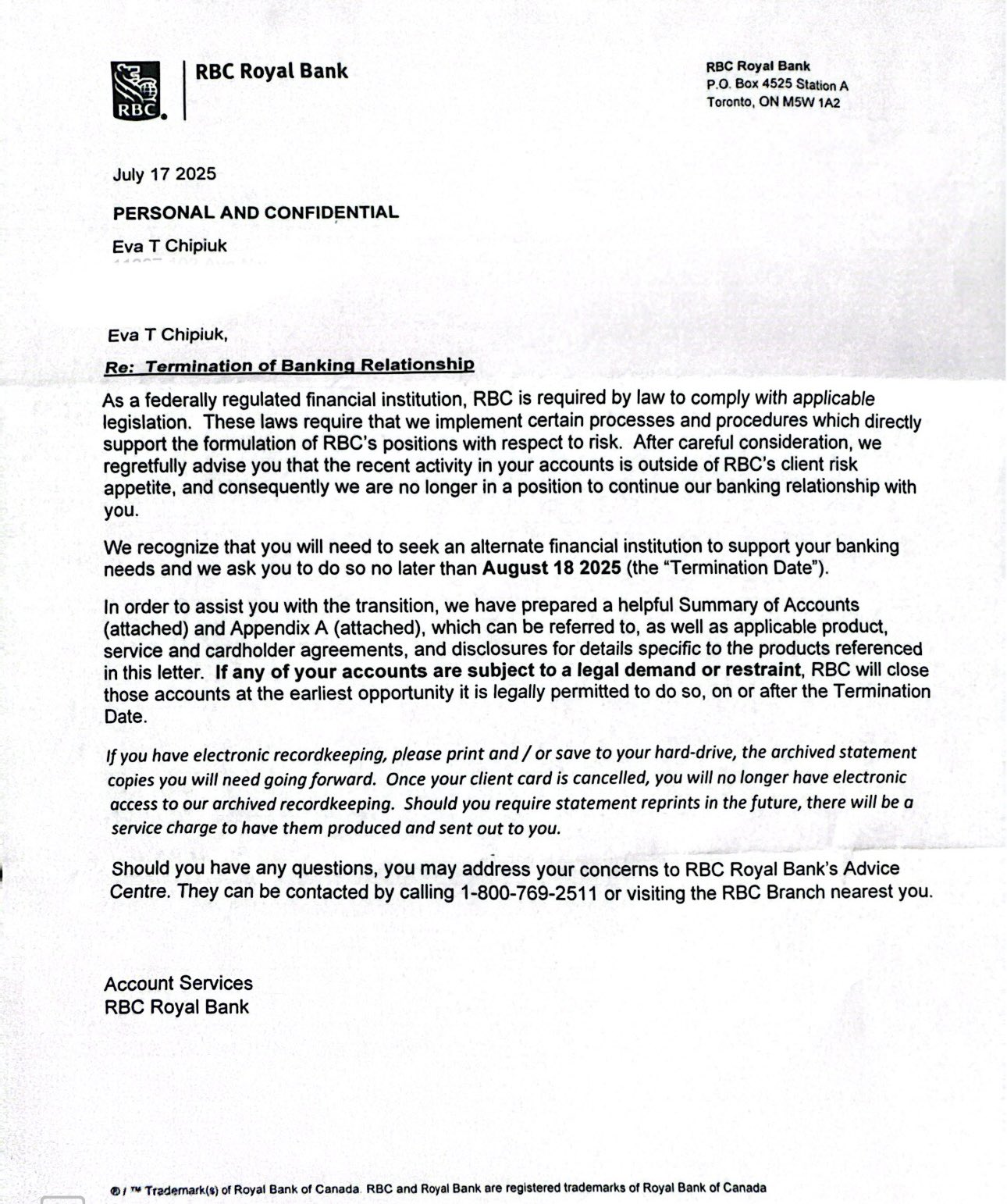

The case of Eva T Chipiuk serves as a stark example of RBC’s troubling debanking practices. On July 17, 2025, Chipiuk received a termination letter from RBC, stating that her account activity fell outside the bank’s client risk appetite, with a demand to find a new financial institution by August 18, 2025. The letter offered no specific reasons, leaving Chipiuk and observers questioning the motives behind this abrupt decision. The lack of transparency, a recurring theme in RBC’s operations, suggests a pattern of debanking that many perceive as politically driven. A post on X by @RealAndyLeeShow on July 23, 2025, called RBC a corrupt institution acting as a political censorship apparatus, echoing public sentiment that such actions may align with external pressures, possibly from government or political entities. While no direct evidence confirms political motivations in Chipiuk’s case, the absence of a clear explanation fuels speculation of tyrannical overreach, disrupting her financial stability without due process or justification. This move, overseen by RBC’s leadership, demands accountability from David McKay, Graeme Hepworth, and Maria Douvas, who are responsible for the bank’s policies and their execution.

RBC’s history is riddled with controversies that paint a picture of a bank prioritizing profit and image over ethical conduct and client fairness. Since October 2022, RBC has been under investigation by Canada’s Competition Bureau for alleged greenwashing, following complaints from environmental groups and Indigenous leaders like Kukpi7 Judy Wilson. The bank claimed to champion climate goals, including $500 billion in sustainable finance by 2025 and net-zero emissions by 2050, while continuing to fund fossil fuel projects like the Coastal GasLink pipeline. In April 2025, RBC abandoned its sustainable finance goal, citing changes to the Competition Act, a move widely seen as an admission of guilt and a retreat from accountability. This scandal, covered by *The Narwhal* and *Ecojustice*, sparked protests and public outrage, with a 2023 post by @MarkRuffalo on X accusing RBC of trampling First Nations rights while posing as environmentalists. This hypocrisy undermines RBC’s credibility and reflects poorly on its leadership, particularly David McKay, who sets the bank’s strategic direction, suggesting a deliberate attempt to mislead stakeholders in a grave ethical lapse.

Another damning scandal unfolded in April 2024, when RBC fired its former CFO, Nadine Ahn, and treasury executive Ken Mason, alleging an undisclosed personal relationship that led to preferential treatment for Mason. The bank’s investigation, prompted by an anonymous tip via its Speak Up channel, claimed evidence of inappropriate conduct, including text messages and a LoveBook. Ahn and Mason, both married with children, denied any romantic involvement, suing RBC for wrongful dismissal and seeking $49 million and $4.5 million, respectively. RBC countersued, alleging ill-gotten gains, in a legal battle that remains unresolved as of July 2025. This fiasco, detailed in *Toronto Life* and *The Globe and Mail*, exposed a toxic culture at RBC’s highest levels, with leadership accused of rushing to judgment to project moral righteousness. The public shaming of Ahn and Mason, overseen by David McKay and involving Graeme Hepworth in Mason’s interrogation, suggests a leadership more concerned with optics than fairness, marking one of the most embarrassing episodes in RBC’s recent history.

In December 2023, RBC faced a $7.4 million fine from FINTRAC for failing to submit 16 suspicious transaction reports, maintaining outdated policies, and other AML violations, as reported by *CBC News*. This failure indicates a lax approach to combating financial crime, a core responsibility of a federally regulated bank, directly implicating Graeme Hepworth and Maria Douvas. The fine, one of the largest of its kind, erodes public trust, as clients expect their bank to uphold the highest standards. RBC’s operational blunders further tarnish its reputation. In January 2025, thousands of Ontario rebate cheques issued through RBC bounced, sparking widespread criticism on social media, with @CP24 reporting the incident. In March 2025, RBC laid off thousands of employees via cold calls, as reported by @ShaziGoalie on X, highlighting a callous approach to workforce management. A 2023 racism allegation from an Ottawa client who faced police scrutiny over a routine transaction further paints RBC as a bank out of touch with its clients and employees.

David McKay, RBC’s CEO since 2014, has positioned himself as a visionary leader, earning $25.97 million in 2024, including a $6.67 million bonus for the HSBC Canada acquisition. Yet, his tenure is marred by scandals that suggest a disconnect between his public persona and RBC’s actions. The greenwashing investigation is a glaring stain, as he championed climate goals while RBC funded fossil fuel projects. Public protests and media coverage, such as *Bloomberg*’s March 2025 report on McKay urging calm amid trade tensions, highlight his struggle to maintain credibility. McKay’s oversight of Chipiuk’s debanking, while possibly delegated, reflects his ultimate responsibility for RBC’s policies. The vague client risk appetite justification, without evidence or explanation, suggests a leadership comfortable with opaque, potentially discriminatory decisions, a betrayal of client trust that warrants public condemnation for what appears to be a tyrannical approach to banking.

Graeme Hepworth, Chief Risk Officer since 2018, oversees RBC’s risk management, including client risk appetite decisions like Chipiuk’s debanking. His tenure has been marked by significant failures, including the 2023 AML fine and 2025 operational blunders like bounced cheques and mass layoffs. These incidents suggest a risk management framework that is either incompetent or deliberately lax, allowing RBC to prioritize profits over ethical conduct. Hepworth’s involvement in the Ahn-Mason scandal, where he was named in Mason’s court filing as part of the interrogation process, further questions his judgment. The debanking of Chipiuk, under his risk management purview, appears as another example of overreach, with no clear justification provided to the client. Hepworth’s failure to ensure fair and transparent processes is a serious lapse, deserving of public scrutiny for enabling what many perceive as politically motivated actions.

Maria Douvas, appointed Chief Legal and Administrative Officer in 2024, oversees compliance and legal matters, making her accountable for ensuring RBC adheres to regulations and ethical standards. The greenwashing investigation, AML fine, and layoffs all fall under her purview, suggesting a failure to manage legal and compliance risks effectively. Her role in the Ahn-Mason scandal, where legal processes led to public shaming and ongoing lawsuits, highlights deficiencies in RBC’s legal oversight. In Chipiuk’s case, Douvas’s team likely reviewed the termination process, yet the lack of transparency suggests a legal framework that prioritizes bank interests over client rights. This opacity, potentially shielding politically motivated decisions, is a damning reflection of Douvas’s leadership, warranting criticism for enabling such practices.

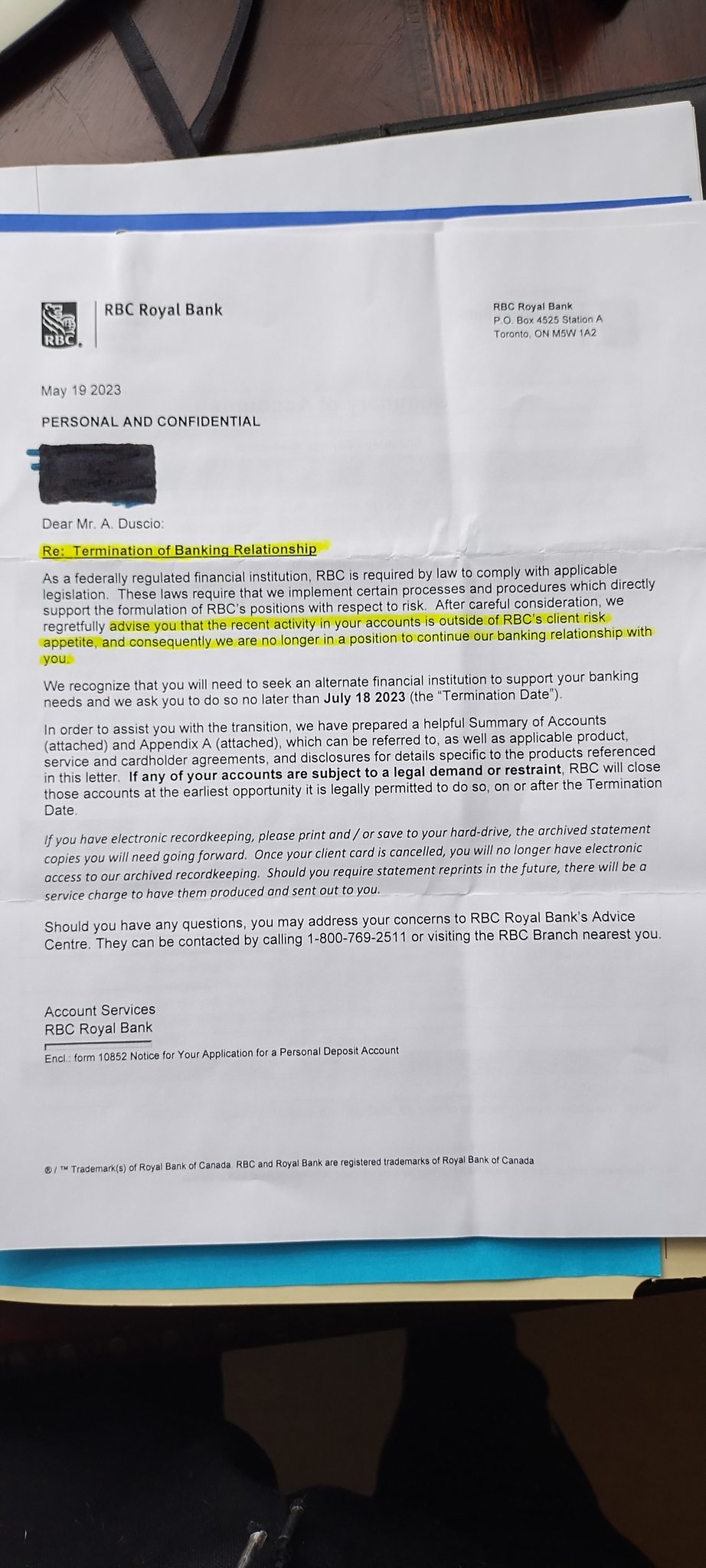

Public backlash against RBC has intensified, driven by its controversies and perceived tyrannical actions. Social media posts, such as @RealAndyLeeShow’s 2025 accusation of RBC acting as a political censorship apparatus, reflect growing distrust. The greenwashing scandal has mobilized environmental and Indigenous groups, while the Ahn-Mason scandal and operational failures have fueled perceptions of a bank more concerned with optics than integrity. Chipiuk’s case, while not explicitly proven to be politically motivated, aligns with a broader pattern of debanking concerns in Canada, as seen in the 2022 Freedom Convoy account freezes and the 2025 Vancity case involving Meghan Murphy. The lack of explanation in Chipiuk’s termination letter amplifies these concerns, suggesting a systemic issue of arbitrary and potentially discriminatory practices under McKay, Hepworth, and Douvas’s leadership.

Royal Bank of Canada’s history of alleged corruption, operational failures, and debanking practices, exemplified by Eva T Chipiuk’s case, paints a picture of a bank that prioritizes power and profit over fairness and transparency. David McKay, Graeme Hepworth, and Maria Douvas, as the architects of RBC’s policies, bear responsibility for these failures, which appear not only unreasonable but potentially tyrannical. The greenwashing scandal, AML violations, and executive misconduct reveal a leadership that has lost its moral compass, leaving clients like Chipiuk to suffer the consequences of opaque decisions. Stakeholders, including clients and the public, are urged to demand accountability by contacting RBC’s Advice Centre at 1-800-769-2511 or escalating complaints to the Financial Consumer Agency of Canada. Publicizing these issues, as Chipiuk and others have done, can pressure RBC to reform its practices. This report, grounded in factual evidence from sources like *The Globe and Mail*, *Toronto Life*, and *National Observer*, aims to shine a light on RBC’s missteps while carefully avoiding legal liability through precise language. The bank and its leaders must face the consequences of their actions, and public outrage should serve as a catalyst for change.

LIKE OUR WORK?